February 1, 2024

In recent years, Oracare Group, a dental clinic conglomerate headquartered in Singapore, has achieved rapid growth, emerging as one of the largest dental groups in Southeast Asia.

Despite operating 62 clinics in Singapore, Thailand, the Philippines, and Indonesia, with a staff of 652 serving 316,700 patients annually, the group plans to double the number of clinics in the next three to five years.

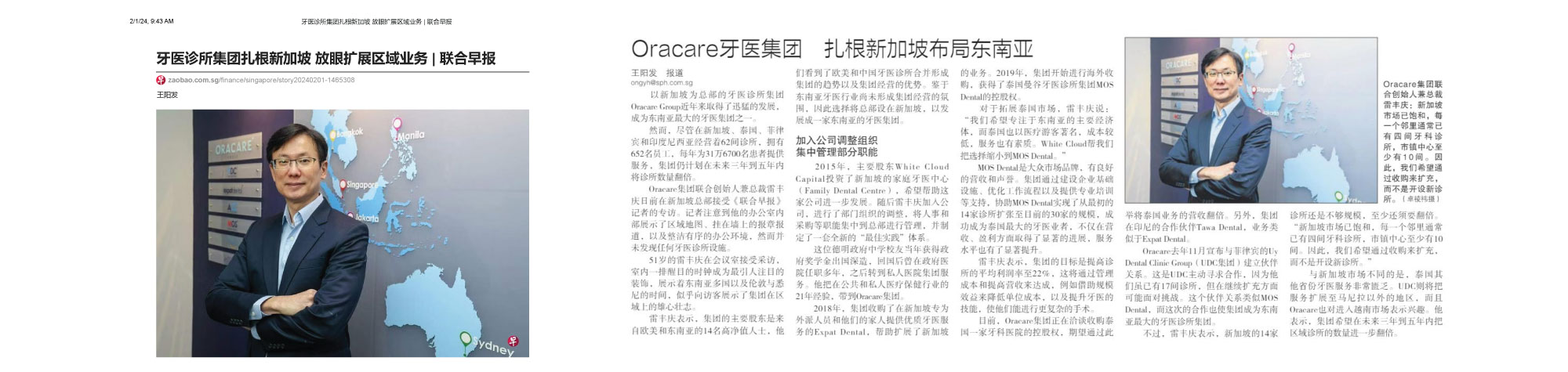

Leon Luai, the 51-year old co-founder and president of Oracare Group, recently sat down for an interview at the Singapore headquarters with Lianhe Zaobao. In his office, adorned with regional maps, newspaper articles hanging on the walls, and a tidy workspace, there was a noticeable absence of any dental clinic facilities. But the walls were adorned with a prominent row of clocks, displaying the times of various Southeast Asian countries, as well as London and Sydney. This seemed to showcase the group’s ambitious regional aspirations to visitors.

Luai mentioned that the primary shareholders of the group are 14 high-net-worth individuals from Europe, the Americas, and Southeast Asia. They recognized the trend of dental clinic mergers forming groups in Europe, America, and China, as well as the advantages of operating as a group. Given that the atmosphere for group operations in the dental industry in Southeast Asia has yet to fully develop, they chose to establish the headquarters in Singapore with the goal of growing into a leading dental group in Southeast Asia.

Joined FDC to organize and centralize management functions

In 2015, the major shareholder White Cloud Capital invested in Singapore’s Family Dental Centre, aiming to facilitate its further development. Subsequently, Luai joined the company and initiated organizational adjustments, centralizing functions such as personnel and procurement management at the headquarters. He also introduced a new set of ‘best practices.’

A graduate of Dunman High School, Luai had received a government scholarship for overseas studies, worked in government hospitals for several years upon returning, and later transitioned to private hospital groups. Bringing 21 years of experience in public and private healthcare to Oracare Group, he took the helm.

In 2018, the group acquired Expat Dental in Singapore, specializing in providing quality dental services to expatriate families, thereby expanding its operations in Singapore. In 2019, the group started overseas acquisitions by obtaining a controlling stake in MOS Dental, a dental clinic group based in Bangkok, Thailand.

Regarding the expansion into the Thai market, Luai mentioned, ‘We want to focus on the major economies in Southeast Asia, and Thailand is known for medical tourism, with lower costs and quality services. White Cloud helped us narrow our choice down to MOS Dental.’

MOS Dental, a mass-market brand with good revenue and reputation, saw significant progress under the group’s support, expanding from an initial 14 clinics to the current 30, becoming Thailand’s largest dental service provider. This expansion not only brought notable improvements in revenue and profitability but also elevated the service standards.

Luai stated that the group’s goal is to increase the average profit margin of the group clinics to 22%, achieved through cost management and revenue enhancement. This includes leveraging economies of scale to reduce unit costs and enhancing the skills of dentists to perform more complex surgeries.

Currently, Oracare Group is in negotiations to acquire a controlling stake in a dental hospital in Thailand, aiming to double the revenue from its Thai operations. Additionally, the group has a partnership with Tawa Dental in Indonesia, a business similar to Expat Dental.

In November of last year, Oracare announced a partnership with the Uy Dental Clinic Group (UDC Group) in the Philippines. This collaboration came as UDC actively sought cooperation due to potential challenges in expanding their 17 clinics further. Similar to MOS Dental, this partnership has positioned the group as the largest dental clinic conglomerate in Southeast Asia.

However, Luai noted that the 14 clinics in Singapore are not yet of sufficient scale and need to double at least. ‘The Singapore market is saturated, with typically four dental clinics in each neighborhood and at least ten in town centers. Hence, we aim to expand through acquisitions rather than opening new clinics.’

Unlike the Singapore market, dental services are scarce in other provinces of Thailand. UDC plans to extend services beyond Manila, and Oracare is also interested in entering the Vietnamese market. Luai mentioned the group’s ambition to further double the number of regional clinics within the next three to five years.